NBN wholesale market: what happened to competition?

Figures recently released by the Australian Competition and Consumer Commission (ACCC) confirm what many industry observers have predicted for some time – the creation of the NBN is not leading to a more diverse and competitive telecommunications market.

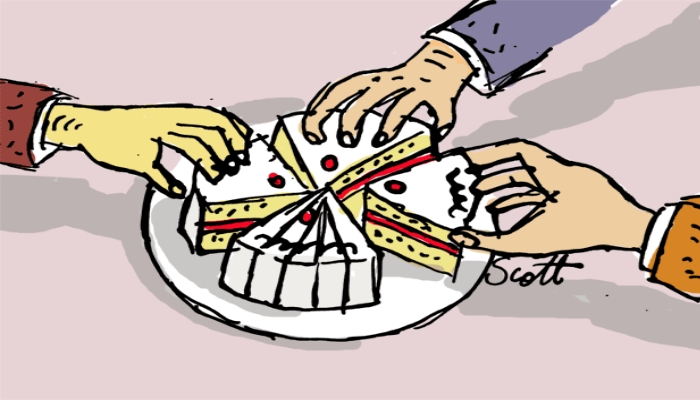

According to the ACCC, nearly 75% of the 1,136,000 NBN wholesale services purchased by 30 June this year were shared between two Retail Service Providers (RSPs) – Telstra and TPG. Telstra accounts for 48.2% of the market and TPG (which incorporates Internode and iiNet) has 26.1%.

Optus, a particularly vocal supporter of the NBN project- or more precisely of the structural separation of Telstra – at the time it was initiated has 13.6% of NBN wholesale services to date.

Commentators have remarked that these numbers may reflect, in part, Telstra’s stronger presence in the regional areas where much of the initial NBN roll-out has taken place. If this is so, then Telstra’s share may eventually fall to closer to 40%.

But there is no reason to expect any major change to the structure of a market which is currently being shared between four players – Telstra, TPG, Optus and Vocus – which between them account for 93% of all NBN services purchased.

So much for the argument, advanced particularly by the ACCC at the time, that a wholesale-only NBN, based on a forced restructuring of Telstra’s fixed line business, would promote competition. As has been clear for some time, the pricing structures of the NBN are such that only those retailers with the deepest pockets can survive.

Whatever the merits of the NBN project, providing the soil in which thousands of RSPs can bloom is clearly not one of them.