Ask Dan - Part time - impact on Superannuation

A member has asked this question: I am a part time employee in Post and an APSS member. I want to reduce my part time hours. Will that affect my Final Average Salary (FAS) for Superannuation?

The short answer is “No” - your FAS cannot reduce and so won’t be affected if you reduce your hours to part time. Instead, when your super is calculated as you retire or resign, your years of service will be reduced to reflect the period of time you worked reduced hours.

For APSS 14.3% defined benefit members, super is calculated using the following formula:

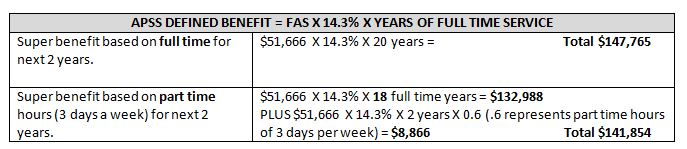

APSS DEFINED BENEFIT = FAS X 14.3% X YEARS OF FULL TIME SERVICE

Your FAS is your average super salary before tax on your last three birthdays. It is calculated by adding your ‘super salary’ (with certain allowances) for your last three years of service and dividing by 3. Remember that super salary and your actual salary might be different because certain allowances do not count toward your super salary, eg. overtime. (Thanks to APSS web site for some of the words. More at www.apss.com.au)

Example: reduction in hours impacts your APSS super

Maria is age 58 and a 14.3% defined benefit member and has worked for Post for the past 18 years. She wants to retire at age 60 and is considering moving from her current full time role to a part time role at 3 days a week for the next two years until she retires. She wants to know the impact on her super.

Maria’s last three super salaries on her birthday were $48,000, $52,000 and $55,000. Her FAS is therefore $48,000 + $52,000 + $55,000 divided by 3 = $51,666.